Download PDF Excerpt

Videos by Coauthors

Follow us on YouTube

Rights Information

What The U.S. Can Learn From China

An Open-Minded Guide to Treating Our Greatest Competitor as Our Greatest Teacher

Ann Lee (Author)

Publication date: 01/09/2012

Find out more about our Bulk Buyer Program

- 10-49: 20% discount

- 50-99: 35% discount

- 100-999: 38% discount

- 1000-1999: 40% discount

- 2000+ Contact Leslie Davis ( [email protected] )

Ann Lee is a Senior Fellow at Demos and the author of the forthcoming book'What the U.S. Can Learn from China."" She also teaches graduate finance and economics at New York University and was formerly a professor at Peking University and Pace University. Before that, she was a former investment banker and hedge fund partner. Ms. Lee was educated at U.C. Berkeley, Princeton, and Harvard. She has been widely published in mainstream media such as The Financial Times, The Wall Street Journal, Newsweek, and Businessweek and regularly guests on CNBC, Fox Business, Bloomberg, CNN and many other television and radio stations around the world.

1

The China Miracle

Success usually comes to those who are too busy

to be looking for it. —HENRY DAVID THOREAU

CHINA’S STEADY AND SPECTACULAR RISE in the last twenty years has perplexed many experts in Western circles. It has generated much intellectual debate as well as a wide range of emotions among Western academics, policymakers, politicians, and the public at large as people struggle to understand the manifold causes for the shift in international, economic, and political power.

Once isolated from the world and threatened by the West, China learned to change its fortunes dramatically in these last three decades. China burst onto the world stage a little while after the diplomatic breakthrough between it and the United States in 1972. Particularly in the last decade, since its accession to the World Trade Organization, China astounded observers around the world with its speed of urbanization, its modernization, its reduction of the number of people in poverty, and the sheer volume of foreign-exchange reserves it holds. China has accomplished much just in the last 15 years including the following:

• 118 megacities with over 1 million people each1

• Over 6 million college students graduating per year2

• Over 420 million Internet users3

• Over 800 million cell phone users4

• 271 billionaires5

• High-tech exports reaching 20 percent of the total global market6

• Auto sales reaching 18 million units a year, making China the world’s largest auto market7

• Largest number of Initial Public Offering (IPO) issuers in the world, making up 46 percent of global IPO value8

Though China is still considered an emerging market economy (EME), most experts would put it in a separate category from developed and developing nations because of its unique set of features. It can be described as simultaneously rich and poor, advanced and backward. With 56 ethnic groups and an even greater number of dialects, most experts agree that China is so vast, complex, and dynamic that discussing it as one entity gets tricky.

Nonetheless, I intend to select and explain a few key concepts about China’s development that I believe have broader applications for the benefit of the United States and the world. By highlighting these specific practices and principles used by the Chinese that contributed much to their recent successes, I hope to export their model for economic accomplishment and gradual civil society reforms so that other countries can modify their systems of governance to match China’s effectiveness. This is not to say that China’s model is perfect or that it should be duplicated in every way. The suggestion, rather, is to set aside societal conditioning that could blind us from learning from a worthy competitor.

While certain personalities and other singular factors have no doubt influenced history, the overriding reasons for China’s success lie in institutionalized values and methods that have worked for generations. Their way of governance has elicited the willing participation of over a billion people even post–Tiananmen Square, despite what some Western media would have us believe. The Communists, though not seen as infallible by the Chinese, at least have been credited with freeing China from a century of foreign imperialism, a period in their history that they view as dark, shameful, and never to be repeated. To the extent that the Chinese can feel proud of their nation’s accomplishments and confident that the government can steer their progress, they prefer the current government to alternatives.

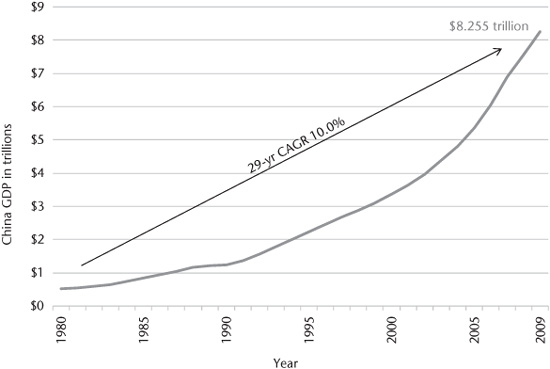

FIGURE 1 China GDP 1980–2009

Source: World Bank. Note: GDP is in 2005 purchasing power parity; CAGR = compound annual growth rate

Surely, some of the ways China competes now in global trade are not dissimilar to the mercantilist tendencies of the United States before World War I. The United States also used to compete with the Europeans by undercutting Europe’s prices. Like the Chinese today, the United States collected a large current account surplus in the process.

America’s once-polluted cities and poor labor conditions, as evidenced by the Triangle Shirtwaist Factory Fire of 1911, also have contemporary parallels in China. The poor working conditions in some of China’s big cities have lead some to believe—particularly Americans who currently live in China—that China is simply following America’s trajectory in history. China’s modern development undeniably will exhibit some of the same characteristics of early 20th-century America. China, for instance, has even started to redistribute income with minimum wage laws and transfer payments through higher taxes.9 But misunderstanding or overlooking some of the differences between U.S. development and China’s development can cause Americans to miss opportunities to learn from the Chinese. Historical study can offer only a partial guide for developing future policy initiatives. Understanding China’s strategies and appreciating the implications of those differences, on the other hand, can lay the groundwork for potentially more advanced civilizations than what exists today.

While I have no doubt that some will disagree with sections of my analyses and/or conclusions for how they might be applicable to the United States, their very disagreements will hopefully propagate more reasonable opinions and ideas because in-depth discussions can beget real progress. There will always be critics who will remain unconvinced no matter what facts, figures, or reasons are presented. One such critic is my own father, who has admitted to me that he will be biased against China’s leadership no matter what evidence I cite because the Chinese Communist Party (CCP) ruined his family, stole their wealth, and condemned them to a life of hardship and misery when it came to power under Mao Tse Tung. However, my intention in writing this book is not to stir emotional outbursts but to arouse reasonable debate and out-of-the-box thinking. The book, I hope, will promote more deliberative discussion about the appropriate role of governments, the extent of their powers, the conditions and circumstances of when those powers should be granted, and which elements are worth keeping and which ones should be tossed. Worlds are beginning to collide, so we will be forced to think about these issues sooner or later.

Global problems will require new global leadership to address with courage the serious issues of unsustainable natural-resource depletion and pollution that have been allowed to fester for decades. Business as usual could eventually lead to a worldwide crisis that surpasses everyone’s worst fears. The fundamental thesis of this book is that all nations can and need to work together to avoid an eventual Malthusian crisis, a catastrophe in which the planet can no longer support the human population, as predicted by Thomas Malthus. The key to cooperating may be found in some examples of China’s governance. China is not a totalitarian regime like Russia during the Cold War. Unlike those in most authoritarian regimes, China’s leaders have earned their authority through a lifetime of meritocratic service that is far from arbitrary. Their system of earned authority actually resonates strongly with Western values, is surprisingly popular with its population, and may even be used to strengthen today’s democratic institutions.

A country must choose its allies and enemies carefully. Like the Roman Empire whose seeds of its own destruction resulted from its miscalculated relationship with the Germanic world due to its perceived Persian threats, the United States risks destroying itself if it attempts to fight imagined enemies like China and bestows misplaced trust in dubious allies such as the Pakistan government or Afghanistan’s president Hamid Karzai who are arguably more corrupt, bigger violators of human rights, and potentially more dangerous than China. By diverting precious time, energy, and talent toward fighting endless wars rather than funneling them for more constructive uses, the United States may unwittingly create its own downfall. Overextended military aggression abroad and unrestrained military buildup at the expense of other investments can ultimately backfire. Fighting for a larger share of a shrinking pie could yield far less than working cooperatively with nations like China to grow the pie so that all parties can enjoy bigger pieces. The United States needs the wisdom not to let hubris get in the way and the courage to root out its own corrupting elements. Both of these will be discussed in detail in the following chapters. Borrowing some of China’s best practices may help the United States close the gap between our current reality and our professed democratic ideal.

Another Japan?

Skeptics simply say that Americans should ignore China because they’ve heard the same hysteria before when Japan was on the rise in the 1980s. The fear that the Japanese were going to take over the world was laid to rest after the Plaza Accord. In this agreement, the developed nations requested that Japan more than double the value of its currency in relation to the U.S. dollar between 1985 and 1987. When the Japanese exports all doubled in price in a timeframe spanning less than two years, naturally the country was unable to export the same volume to the world. Japanese companies suffered severe financial losses. Layoffs and massive reductions in labor wages followed for the next two decades, now referred to as Japan’s Lost Decades. Even if some argue that Japan’s problems were homegrown, the timing of this agreement no doubt precipitated and exacerbated the subsequent fall. Foreign exchange plays an integral role in all cross-border commerce. In the case of Japan, where the lion’s share of its economy was dependent on exports, the forced appreciation of its exchange rate caused many of its businesses to become less profitable. When loans to these less profitable businesses soured, Japan’s banking sector was thus harmed, causing a dramatic fall in its stock market as a domino effect.

Certainly it is within the realm of possibility that the United States will attempt to do the same thing to China to neutralize it as a potential economic threat. The Financial Times reported on February 8, 2011, that the United States had attempted to enlist Brazil in a united front against China’s pegged currency policy ahead of a G-20 meeting. This move is just one of the ways that the United States attempted to hobble China’s economic growth. It follows years of Western media and policymakers calling China a manipulator of currency in attempts to pressure China to appreciate its currency, the yuan, faster or to loosen its peg so that the yuan would free float. “Deregulation of China’s currency” is merely another way of saying “Let the foreign exchange traders have the power to manipulate the value of the currency to their ends.”

Many differences between Japan and China, however, lessen the likelihood the United States will pursue this route, starting with the fact that China has welcomed significant direct investment from the United States and other countries while Japan was a more closed society. Japan’s exports were largely high-end electronic products, designed and produced entirely by Japanese companies. Japan did not experience a flood of foreign direct investment. Its success came as Dr. W. Edwards Deming helped Japanese companies become the most competitive in the world with his theories of Total Quality Management (later modified and elaborated upon by other management experts so that now these ideas are collectively referred to as Six Sigma by manufacturing concerns). Dr. Deming had first approached American manufacturing companies with his theories of benchmarking and other ideas for improving production quality, but he was rejected by all of them because he was considered too radical by top American executives back in the 1940s and 50s. As it turned out, Dr. Deming discovered that the Japanese openly embraced his ideas, so he worked with them instead and helped them rebuild their manufacturing capabilities after World War II to become the best in the world.

Fast-forward to China, and we see a different story. Unlike Japan, China threw open its doors to the world and received significant foreign investment from every corner of the earth. China offered the dual allure of a giant consumer market and a seemingly infinite supply of cheap labor, attractions that foreign companies found irresistible despite the innumerable risks of doing business in a Communist country. Additionally, the explosion of Internet services, which didn’t exist during Japan’s rise, made it possible to coordinate offshoring and outsourcing with greater ease and at lower cost. With costs of communication and shipping coming down, multinational companies and entrepreneurs from around the world were able to rely on the Chinese to turn their ideas and dreams into reality.

So unlike Japan, exports out of China are not Chinese exports per se but instead belong to American companies, German companies, Dutch companies, and a long list of others who have vertically integrated China into their supply-chain processes. The goods leaving China and arriving in the United States mostly originated from American businesses and are sold to American consumers; the Chinese merely assisted in putting the products together and account for no more than a quarter of the value added. In 2009 Behzad Kianian and Kei-Mu Yi at the Federal Reserve Bank of Philadelphia reported that of the $644 billion the U.S. consumer spent on goods made in China in 2007, roughly $322 billion was attributed to wholesale markup, retail markup, domestic shipping, and profit margin for U.S. companies. Of the remaining balance, an estimated $161 billion was attributed to imported inputs, and only $161 billion went to the Chinese for assembly or other labor intensive work.

The evidence is clear; the aisles of a typical store in America are filled with U.S. branded products made in China but virtually no Chinese brands. These American brands range from well-known companies like Nike and Apple to the millions of small, unknown business owners running businesses out of their own homes. Just because the goods crossed national borders doesn’t mean that the Chinese owned them or made the lion’s share of profits. Rather, when foreign companies chose to assemble their widgets in China rather than in their home markets, they were making a decision on what would make their business operations most profitable.

Perception rather than reality is dictating U.S. policy when it comes to jobs. It’s not necessarily the case that China took jobs away from American workers. Those jobs may have never existed in the first place if China hadn’t provided the inexpensive labor. The wages in developed countries are much higher, a factor that could have deterred entrepreneurs from even launching a business. But with China in the picture, more companies were willing to take the risk because the profit potential was more attractive. China’s cheap labor and manufacturing capabilities enticed Western entrepreneurs to pursue projects that in turn required support at home in other areas, for example, sales, marketing, branding, retailing, accounting, legal services, and finance. Thus China indirectly contributed to the United States moving up the food chain toward what is now referred to as a knowledge economy. In contrast to an industrial economy, the critical drivers of job creation and economic growth in a knowledge economy are entrepreneurial ideas, intellectual property, and the reliance on expertise such as research and development (R&D) professionals.10

Since the profitability and even viability of many U.S. companies both large and small are directly tied to the cost of their operations in China, it is not in their interest to see the Chinese currency appreciate rapidly. A rapid rise would immediately impact the profits of U.S. companies since they cannot quickly move their operations to Vietnam or India where production costs are low, but the physical infrastructures are significantly poorer than in China. In addition, a rise in the value of Chinese currency would decrease the relative value of the dollar, reducing American consumer spending power and resulting in a loss of sales for American businesses.

A rapidly rising yuan would also be bad for the United States because the Chinese could use its stronger currency to buy up even more natural resources around the world or snap up U.S. assets at fire-sale prices. Moreover, an American company with overseas profits will not want to repatriate its profits back home if it will be more profitable to keep the money in a rapidly appreciating currency. If American companies were to keep their money in China, then they would invest less at home, spelling even higher unemployment in the United States.

Finally, if the yuan were to appreciate too rapidly, precipitating a Japanese-style Lost Decade, most Chinese export companies that operate on razor-thin margins would go bankrupt and lay off millions of Chinese workers; this happened during the financial crisis of 2008.11 Without a growing middle class in China, the world will have no immediate replacement market to sell its wares, given that citizens of developed economies are still hamstrung with enormous debt loads and many developing nations rely overwhelmingly on China to continue their economic growth.12 Global trade would again come to a screeching halt, and the United States would probably be blamed for crafting such an agreement. So for all the above reasons, it is unlikely that the United States would push for another deal like the Plaza Accord, despite the vituperative threats from Senator Charles Schumer or other American politicians who regularly engage in bashing China because they think the yuan should be artificially appreciated.

Another Bubble?

Others, such as hedge fund manager Jim Chanos, believe that China will eventually implode due to its inefficient allocation of resources to infrastructure investment. They believe that China’s high growth rate due to its building frenzy is unsustainable. Some see this as Russia redux in which too much central planning from a powerful government will ultimately bankrupt its economy.

While the Chinese investment in infrastructure is indeed high compared to other nations, it is actually not so out of line when compared to the United States during its Industrial Revolution over a century ago. For example, the United States had four times the number of railroad miles during that time period than exist today, but such “overinvestment” did not derail the young nation. Similarly, China will undoubtedly create wasteful infrastructure from less-than-optimal allocation of resources. Stories of empty office and apartment buildings abound. But a closer look reveals that most infrastructure investment since the 2008 crisis has gone to retail housing where demand shows no sign of relenting. Construction and real estate have stayed steady at roughly 10 percent of the gross domestic product (GDP) since the mid 1990s. Total property investment as a share of total fixed asset investment was roughly 20 percent in 2008, and residential property made up approximately half of that number.13

The migrant workers that flow into China’s coastal cities from Western China are akin to the waves of immigrants in the tens of millions that arrived on American shores throughout the Industrial Revolution. The share of the urban population in China went from less than 30 percent in 1990 to almost 50 percent by 2009, while the share of agricultural employment has dropped from 60 percent to 40 percent during the same time period.14 We can expect China’s urban population to rise another 20 percent if it is to reach comparable urbanization rates of other developed countries like Japan and Korea.

Furthermore, the risk of China imploding from overinvestment seems highly unlikely because credit expansion is small compared to the West even after the financial crisis of 2008. According to Fitch Ratings, China’s government debt-to-GDP ratio is 21.5 percent. The U.S. federal debt-to-GDP ratio, on the other hand, was just shy of 100 percent in 2010. American household debt-to-GDP reached 100 percent in 2007, while the Chinese household debt-to-GDP was a mere 12 percent in 2008. Union Bank of Switzerland (UBS) and Goldman Sachs estimated that in China, household debt as a share of disposable income was under 60 percent in 2009 and will likely remain so for some time to come given the government’s proactive tightening of credit. Household debt in the United States, by contrast, is estimated at over 120 percent of disposable income in 2009. Excess leverage that defaults or causes fear of defaults is usually the trigger of financial crises. Based on conventional measures of debt levels compared to the amount of equity and bank reserves borrowed against them, that condition is far from reaching a tipping point in China. Besides, housing is the only financial asset for many Chinese. Excess housing units that sit empty won’t get abandoned because they were secured with substantial down payments of 50 percent or more and so function as a store of wealth. Some have been paid for in full in the same way some investors hold gold bullion in vaults as a hedge against inflation.15

Finally, Westerners must also not overlook that private market forces can be enormously inefficient and won’t necessarily do a better job than government-induced investments. After all, private markets were responsible for the speculative manias that funded everything from Dutch tulips to profitless Internet companies. By now, volumes of research, coming from such organizations as the Bank for International Settlements (BIS), indicates that market failures happen regularly, so China’s political economy should be no more likely to suffer an economic setback than more self-proclaimed market-oriented economies.

Economic bumps on the road in China obviously cannot be ruled out as property prices and stock market prices fluctuate. However, I would argue that fluctuations in valuation must not be confused with the bigger fundamental picture of steadily growing development needs. But regardless of what China’s fate will be in the coming decade, the Chinese leaders have already proven in the last few decades that they have created a compelling recipe for running a country with a population more than four times the size of the population in the United States. Francis Fukuyama, the author best known for writing the book The End of History, stated in the Financial Times on January 18th, 2011, that “its [China’s] specific mode of governance is difficult to describe, much less emulate, which is why it is not up for export.” I have to politely disagree. Even if China and the West seem worlds apart in history, culture, and governance, it is possible that the United States can learn from China just as China has learned and continues to learn from the West. Let me just cite a few examples of what China has already learned from the West:

• China has learned to adopt capitalist market principles (within a Communist framework).

• China has learned to manufacture many types of products it never used to have, from laptops to high-speed trains.

• China has learned to conduct business according to international rules created by Western countries, like the United States.

• China has learned to incorporate religion in a way that doesn’t pose a threat to the State.

• China has learned to appreciate Western fashion, fast food, rock music, and reality shows that were completely foreign to their culture.

• China has learned to create social safety nets like pension plans and health insurance for its population.

No doubt there is still plenty for China to learn from the West. The last chapter of this book highlights some of the things that the United States does particularly well that China should adopt. There are obviously many areas that China needs to address or improve, but the main thrust of this book is to talk about what works in China, so that Americans can seize an opportunity to learn and improve in areas that the United States has been lacking in our recent past. Some of our weaknesses are some of China’s strengths. No country, including China and the United States, has a monopoly on superior morality or knowledge, but the nations who understand their weaknesses and strengths, and can evolve accordingly, will have time on their side.

China’s leaders still face significant problems in the years ahead, and the governance of the Peoples Republic of China (PRC) is not guaranteed to succeed in the coming decades. Among some of the serious challenges facing Chinese leaders are their ability to continue growing without inflation getting out of control, their ability to manage the large wealth inequalities, and their ability to smoothly transition from a heavy industrial economy to a more service-oriented economy while cleaning up the vast environmental pollution.

However, China’s principles for governance provide a powerfully viable framework for economic progress that has thus far enabled it to dodge the bullets that would have taken down a weaker government. Instead of wallowing in negativity and despair over their misfortunes, the Chinese turned perceived threats—such as the global financial crisis of 2008—into opportunities and advantages around the world. When a government appears credible by maintaining stability and benign conditions for people to thrive, people are motivated to work and achieve because their faith in the institutions and its leaders makes them believe they have a future. They endure significant hardships through the belief that the fruits of their labor will someday be rewarded even if the rewards are not immediate. So as long as the Chinese believe in their government’s ability to lead, it is reasonable to expect that the citizens of China will continue to find ways to prosper despite the multitude of obstacles.

This is good news for America and the world. For decades, America and Washington DC–based institutions such as the World Bank and the International Monetary Fund (IMF) dictated their market-friendly, economic reform policies known as the Washington Consensus to weaker developing countries.16 There is now overwhelming evidence that this set of policies contributed to the downfall of those economies.17 After the financial crisis, the World Bank and IMF began rethinking those policy recommendations when the Seoul Development Consensus was endorsed by the G-20 in 2010.18 Had China listened to Western policymakers, it is highly probable that its continuous growth in the last two decades would not have been achieved. China might have looked more like Argentina or many other countries that adopted the Washington Consensus to modernize their economies after suffering from a colonial past. But China has been one of the few countries wise enough to resist Washington’s economic demands to open its financial markets prematurely, choosing instead to pursue its own policies, which have served it well thus far.19 It is one of the few industrialized nations of the world that has not allowed its economy to be crippled by financialization, a phenomenon that I explain in chapter 6. Without China’s growth, America and the rest of the world most likely would have hit bottom almost a decade earlier when the Internet bubble burst. But because of China’s steady and rapid development, U.S. corporations were able to continue achieving record profits. These corporations grew their profits by increasingly selling to overseas markets, lowering their labor costs through outsourcing and offshoring jobs, and accessing low borrowing costs as an indirect result of China’s reinvestment in U.S. Treasuries.20 China’s large purchases of U.S. Treasuries (over $1 trillion) helped keep interest rates low in the United States. By providing a steady demand for U.S. bonds, bond prices did not fall and thus interest rates remained low.21 In other words, China’s well-managed political economy gave the rest of the world a new lease on life the same way America was a powerful economic growth engine for the world during the 20th century.

Game Changer

In the following chapters, I explain in greater detail the institutional as well as cultural elements that I believe have catapulted China from a backward agrarian nation into a leading economic power. The significance of China is not that it may overtake the United States in traditional measures of power, but that it will take on an important role in changing the game being played. With the benefit of hindsight, historians can look back and see how the Industrial Revolution in Britain changed the world. Had someone recognized the economic, technological, and political trends back then, one might have predicted the extensive reach and duration of the British Empire. More importantly, I discuss how China turns its aspirations into reality, and I point out how these methods could apply to Western democracies. China can play an integral part of the solution in the coming decades with its rapidly modernizing economy and incipient innovations in process manufacturing and product development. Americans ought to resist the temptation to fight the inevitable rise of China’s importance and its contributions to the world economy. By treating China as a critical partner in solving global problems, America and the rest of the world may avert the frictions that could lead to Armageddon and instead pave the way for the next Renaissance.

As part of my discussion about why China succeeded, I also provide context as to how China has interacted with the nations of the world based on their institutions, their thought processes, their values, and their history. I also cover how China will likely address the major long-term issues facing the world today. Make no mistake, this is not a book about China, but rather about the enduring principles China has reliably followed for approaching global problems, the way America brought Western democratic capitalism to the world. In order to unleash much pent-up talent and increase the natural rate of innovation, a new ideology must replace old belief systems and ways of doing things. Integrating China’s methodologies into Western practices could be a promising way of getting there.

Research for this book comes from years of discussions and interviews with countless individuals in both the private and public sectors in the United States and China. My work as a professor at both Peking University and at New York University as well as my position as a senior fellow at Demos, a nonpartisan think tank, give me the benefit of exchanging ideas and information with people around the world, who include CEOs, academics, investors, ambassadors, journalists, students, inventors, entrepreneurs, media executives, policymakers, lawyers, engineers, and bankers. Sifting through all this information for my classes, speeches, and other engagements, certain trends became increasingly obvious to me. By describing these trends and providing a framework through this book, I seek to introduce a distinct perspective for interpreting today’s world and offer solutions that have rarely been discussed in mainstream media.